From FNOL to Final payout: What is the impact of AI on the claims lifecycle

The insurance claims process has traditionally been characterized by lengthy processing times, manual documentation, and potential inconsistencies in assessment. As the tech world continues to evolve, artificial intelligence is transforming this landscape by streamlining operations, enhancing accuracy, and improving the overall experience for both insurers and policyholders.

Modern consumers expect rapid, transparent, and efficient service across all industries, and insurance is no exception. The pressure to meet these expectations while managing costs and maintaining accuracy has led many insurers to explore innovative technologies. AI represents one of the most promising solutions to address these challenges comprehensively.

This article examines how AI technologies are revolutionizing each stage of the claims lifecycle, from first notice of loss to final settlement. We will be exploring many limitations that include conventional approaches and the significant benefits that automated solutions provide, while also acknowledging current challenges in implementation.

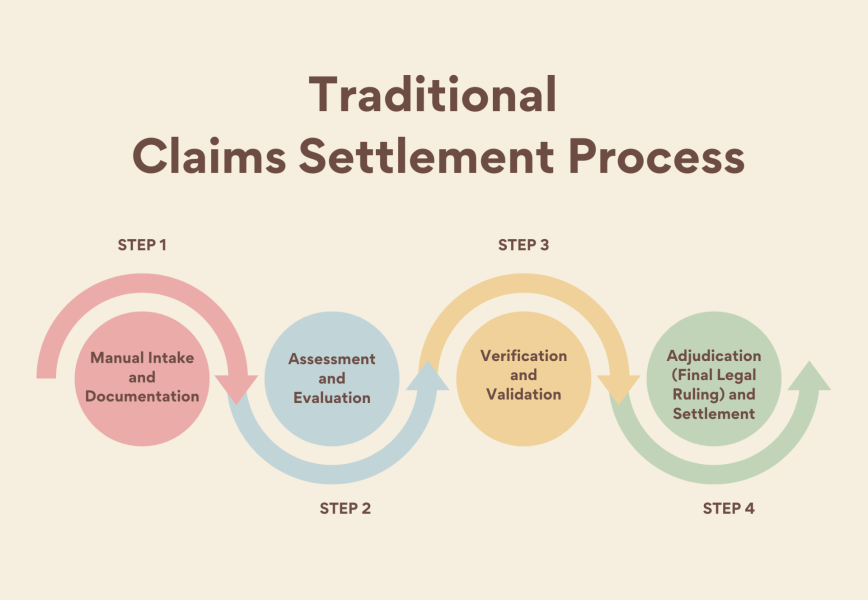

Understanding the traditional claims lifecycle

The insurance claims process follows a structured sequence of steps designed to assess damage, determine coverage, and provide appropriate compensation. Each step gives a specific purpose in the entire workflow.

First Notice of Loss (FNOL)

The claims journey begins when a policyholder reports damage to their insurance provider. This important first step involves the collection of essential information including date, time, and location of the incident, vehicle details, documentation of damage in terms of photos, police reports when applicable, and information regarding the third parties that are involved.

This initial documentation establishes the foundation for all subsequent claim-processing activities. The accuracy of FNOL data collection directly affects the processing speed and claim accuracy throughout the whole lifecycle.

Claim registration

Once the insurer receives the damage notification, they verify policy coverage details, create an official claim record in their system, and provide the policyholder with a unique claim reference number for tracking purposes.

Preliminary assessment

During this step, claims are categorized based on the severity of the case. Minor claims with a clear documentation may be divided for a much faster processing, while more important or complicated cases receive flags for detailed investigation. This approach helps insurers distribute the resources appropriately.

Damage assessment and inspection

This represents one of the most important stages in the entire claims process. Inspectors create an in-detail report documenting all damage specifics, often requiring a physical examination of the vehicle. These assessments provide the factual basis for coverage decisions and determine the appropriate course of action for claim resolution.

Claim investigation

Additional investigation procedures may be applied for claims involving suspected fraudulent activity, particularly large financial exposure or complex third-party liability considerations. These investigations help to protect insurers from improper payouts while ensuring legitimate claims receive appropriate consideration.

Approval or authorization

Based on vehicle inspection findings and the terms, insurers decide the appropriate action through an in depth evaluation process. The primary decision involves determining whether a vehicle should be repaired or concluded as a total loss.

Repairable loss determination: When repair costs remain below a percentage of the vehicle’s actual cash value, which is typically 70-80%, insurers approve repair authorization. This includes approval for partial repairs addressing specific damage areas, complete restoration covering all incident-related damage, or component replacement when repair is not economically viable.

Total loss classification:

A vehicle receives the designation of total loss, when repair costs exceed the decided threshold relative to its value, or when structural damage compromises safety standards. Some policies give replacement cost coverage, providing funds to purchase a vehicle that is comparable at the current market prices.

This decision point represents a critical juncture where repair feasibility, economic considerations, and safety requirements guide the resolution approach.

Repair or replacement implementation

Vehicle restoration typically follows one of two pathways: repairs at insurer-approved facilities for cashless claims or customer-initiated repairs with subsequent reimbursement submission.

Final settlement and closure

The process ends with detailed documentation provided to the policyholder that confirms the settlement details and then a claim closure in the insurer’s systems. This final step represents the successful completion of the cycle.

Challenges with traditional manual claims processing

Time-intensive procedures

Manual claims processing requires significant time investment at multiple stages. Physical inspection scheduling based on staff availability, document processing, manual data entry, and multi-level review procedures for approval decisions can extend claim resolution by days or weeks, creating customer dissatisfaction and operational inefficiencies.

Reliability concerns

Human-centric assessment introduces potential variability, including inconsistent damage evaluation between different inspectors, subjective interpretation of damage severity, and potential oversight of less obvious damage points. These inconsistencies can lead to disputes and assessment revisions that further extend resolution timelines.

Documentation quality issues

Manual documentation processes face many challenges, including handwritten notes susceptible to legibility problems, inconsistent photo documentation practices, and the potential for incomplete damage recording. These documentation limitations can complicate claim verification and lead to processing delays or disputes.

How AI transforms the claims lifecycle

Artificial intelligence technologies are evolving claims processing through automation and improved analytics capabilities:

Enhanced FNOL process

AI implementation significantly improves the initial reporting experience. Policyholders can generate detailed reports directly from the accident sites, also from the intelligent systems where they can extract relevant details from submitted photos, automated systems can immediately validate basic policy coverage, and damage severity can receive preliminary classification without human intervention. These capabilities help to speed up the claim initiation process while also improving information accuracy.

Streamlined claim registration and assessment

Automated systems deliver substantial efficiency improvements. AI can instantly analyze submitted damage documentation, policy coverage verification occurs through database integration, automated severity classification directs claims to appropriate processing channels, and reference numbers are generated automatically with immediate customer notification. This automation reduces administrative overhead while accelerating the transition to substantive claim review.

Revolutionary damage assessment capabilities

Perhaps the most transformative impact occurs in the inspection phase. AI-powered image analysis can help to identify and categorize damage types, assessment criteria tht ensures a consistent evaluation, along with remote inspection capabilities that eliminate scheduling constraints, and comprehensive digital documentation captures all damage aspects.These technologies reduce inspection times from days to minutes while improving assessment quality and consistency.

Reduced investigation requirements

The advanced AI systems help to optimize investigation resource allocation. Automated fraud detection algorithms flag potentially suspicious patterns, claims within established parameters receive expedited processing, and only truly complex cases require human investigator involvement.

Data-driven approval decisions

AI facilitates more consistent authorization determinations through comprehensive data analysis. The technology excels at making complex repairable versus total loss decisions by analyzing repair costs against vehicle values, considering parts availability, labor rates, and safety factors. AI systems can instantly access the current market values, the depreciation calculations, and vehicle pricing that are comparable to determine fair settlement amounts.

Streamlined settlement process

The final stages benefit from comprehensive automation. Digital settlement documentation generates automatic payment systems that facilitate rapid disbursement, and claim closure that occurs through automated workflow progression.

Current limitations of AI implementation

Accuracy considerations

Current AI inspection systems typically achieve 90-95% accuracy rates. While impressive, this still necessitates human verification for certain complex claims to ensure appropriate outcomes. Complex damage patterns may require expert interpretation, and unusual vehicle configurations might not be well-represented in training data.

Fraud detection complexities

Sophisticated fraud schemes continue to challenge even advanced detection systems. Organized fraud rings develop countermeasures to automated systems, and synthetic fraud schemes use legitimate-appearing documentation. Companies like Inspektlabs are developing increasingly sophisticated countermeasures, but this remains an evolving capability.

Internal damage assessment limitations

While external damage evaluation has reached high reliability, hidden internal damage identification presents ongoing challenges for AI systems. Mechanical damage may not be visible in standard photographs, and electrical system problems require specialized diagnostic equipment. Research continues to advance these capabilities through improved algorithms and training methodologies.

System training requirements

AI systems require extensive training to avoid potential errors or “hallucinations” in damage assessment. Proper implementation demands substantial data sets and ongoing refinement to maintain accuracy across diverse claim scenarios and geographic regions.

The future of AI-powered claims processing

Despite current limitations, the trajectory of AI in claims automation processing shows remarkable promise. Companies at the forefront of this technology, including Inspektlabs, continue making significant advancements in damage recognition capabilities, enhanced fraud detection through pattern recognition, improved internal damage assessment methodologies, and more seamless integration with existing insurance platforms.

Many technological developments are enhancing AI capabilities, including advanced computer vision systems and predictive analytics for risk assessment and prevention strategies.

These developments suggest a future where AI facilitates more accurate, and more consistent claims processing across the entire lifecycle.

Conclusion

The inclusion of artificial intelligence into the auto insurance fraud detection lifecycle represents a huge shift in how damage assessment and processing takes place. AI technologies deliver many benefits to both insurers and the policyholders.

The transformation includes every stage of the claims process, from initial reporting through final settlement. AI helps to enable faster, more accurate, and more consistent processing while reducing costs and improving customer satisfaction. Current AI systems demonstrate remarkable capabilities in damage assessment, fraud detection, and process automation, with accuracy rates and efficiency improvements that far exceed traditional manual approaches.

While challenges are not able to achieve complete automation for all claim scenarios, the huge advantages of current implementations already justify adoption. As AI capabilities continue evolving, the gap between traditional and automated approaches will only widen, making AI integration an essential element for competitive insurance operations.